In order for organizations to survive in today’s rapidly changing business environment, CFOs are being urged to step outside their traditional financial role and rise to new technology-driven business challenges, spearheaded by the need to transform data into value-added actionable information

The need to take financial efficiency to the next level was the underlying theme of CFO Experience Day 2019, an annual event tailored for CFOs organized by SAP in collaboration with its partners. At this second edition, high-level speakers from leading companies addressed current topics such as Digital Finance, Financial Analysis and Planning, Optimization of Working Capital, Internal Control and Risk Management, among others, under the umbrella of digital innovation for finance transformation.

The intelligent enterprise

One of the key note speakers was Belén Villasante, Managing Director of Finance Transformation at global consulting firm everis, present as a sponsor at the event.

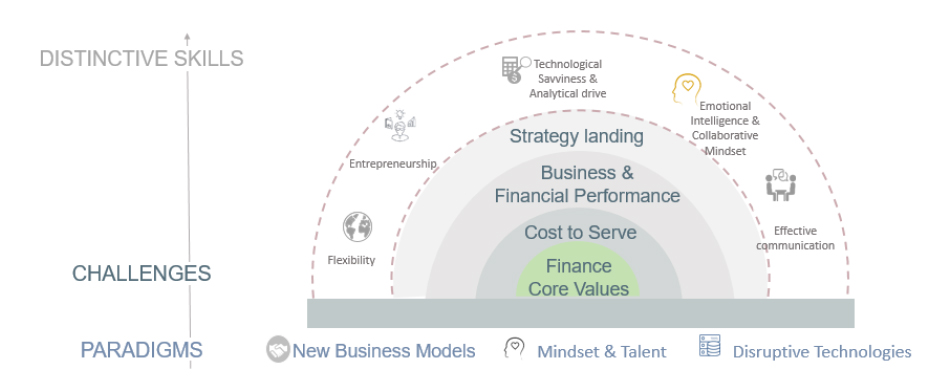

Belén explained how the finance function can help organizations capitalize on their information to create added value and gain competitive advantage in increasingly complex business scenarios: “The new paradigm requires financial executives to take on a more proactive and strategic role by developing distinctive skills, embracing technology and deploying resources to streamline business processes.”

However, this innovation must be implemented across the board and requires a change in mindset, one that advocates a data-driven culture. In this new reality, CFOs are requested to act as orchestrators of that change.

But data on its own is meaningless. Therefore, digital transformation requires the deployment of intelligent analytics tools capable of leveraging the ever-increasing information available to organizations. The aim is to gain insight into business-critical data and build predictive models that will allow them to respond faster to changes in the marketplace.

In this disruptive scenario, the traditional role of the CFO comes under intense scrutiny as finance teams are expected to acquire the technological savviness to understand the solutions available on the market and select those that best meet their organization’s casuistry and objectives.

Rising to the challenge

Belén pointed out the four main challenges that CFOs currently face:

- Guarantors of the organization’s finance core values. CFOs are being asked to go beyond the traditional role of managing and safeguarding company assets to drive business decisions and be co-pilots of digital transformation in their organizations.

- Cost efficiency. This must be achieved at the lowest possible cost through optimized investment decisions in order to ensure bottom-line success.

- Lead the decision-making process. The finance function must be capable of helping the organization to make business-critical decisions by evaluating, measuring and anticipating information needs.

- Help to define and implement the business strategy. Given their holistic vision of the business and wide reach to every corner of the organization, financial controllers are requested to assist CEOs in defining and deploying the strategy.

Digital transformation levers

CFOs are turning to intelligent automation to help them meet these goals by streamlining critical business processes and transforming financial functions into services. In this regard, Belén explained that “leading organizations act on six key digital transformation levers to deliver on that promise.”

- Strategic mission. Design global financial solutions that integrate the needs of all business units of the organization across all geographies and ensure transparency and traceability of information.

- Transformation of talent. Empower finance teams to migrate from reporting on historical data and executing transactions and processes to controlling and managing the output of those processes.

- Analytics. Data-driven organizations generate differential knowledge in real time by implementing integrated analytical models that effectively close the gap between finance and business.

- Operating model. Create new business models based on data monetization and business process optimization through global delivery architecture and hybrid sourcing models.

- Superior service. Finance must transition from a transactional back-office function to an integrated service for business units, suppliers, customers and end users, delivering the best user experience by anticipating and adapting to their needs.

- Automation. Organizations with a digital agenda normally have very ambitious business process transformation and automation objectives, up to 80% in some cases. The five emerging automation technologies with proven results in finance are: Robotics, Analytics, Artificial Intelligence, Blockchain and ChatBot.

However, as Belén points out, “these five innovative technologies cannot achieve their objective individually, but rather must be implemented and used in combination in order to obtain the competitive advantages that organizations seek.”

Blockchain for Finance

In her presentation, Belén placed special emphasis on Blockchain technology and discussed two specific use cases: intra-group financing and instant payments in the utilities and services sector, respectively.

Implemented on SAP Leonardo, a digital platform which allows customers to leverage these emerging technologies on top of their business data, it enabled information exchange in both cases with real-time, secure, traceable, agile and cheaper process execution, in addition to enhanced security, transparency and traceability.

Distributed Ledger Technology or DLT, also known as Blockchain technology, consists of an open and distributed database that serves as a decentralized ledger where digital transaction records are stored, which is geographically spread across several devices on a peer-to-peer network. This database can be configured in a blockchain system, which can be either public or private, in which data are stored in blocks protected by cryptography. This ensures that any changes made to the data are visible to all the parties that are allowed access.

At everis we believe that Blockchain, which has been gathering momentum since its Bitcoin beginnings in 2009, will fundamentally change the way we do business. “Blockchain technology has become the basis for creating secure and transparent transactional applications to streamline business processes in organizations around the world,” she concluded.