How to drive decision making whilst digitalizing Planning, Budgeting and Forecasting during uncertainty times

Recent years have shown the need for business organizations to master mechanisms that allow anticipation and adaptation to an increasingly interconnected reality. Globalization, Volatility, Digitalization at Speed, ESG goals … [visit Voice of Finance], generate a multiplied impact based on the nature of the connections that generate added value for businesses in the first place. Under this scenario where a high factor of uncertainty is present, the ability to plan and simulate business scenarios anytime becomes a must to generate competitive advantage.

The role of the planning director and controller is under great evolution.

Where on top of the well stablished analytical skills and business acumen, the professionals in the ‘Driving Decision Making Career’ are faced with the need to feature superior ability to:

• Constructively challenge the hypothesis and the status quo to advise on action plans.

• Stretch the traditional risk adversity levels.

• Lead multidisciplinary teams by influence whilst aligning a growing and more complex ecosystem of sources and stakeholders.

• Navigate data technologies.

“In NTT DATA we realize the traditional financial forensic approach does not suffice.”

“We apply our particular approach to make this come true.. let’s talk to the financials to figure up the future.”

Within DIGITAL FINANCE PRACTICE AT NTT DATA, THE EPM CoE (ENTERPRISE PERFORMANCE MANAGEMENT CENTER OF EXCELLENCE) is a growing international and multidisciplinary team of consultants:

• Focused and specialized in solving the challenges that Planning Directors and Controllers face today, to evolve from “doers” to “advisors”.

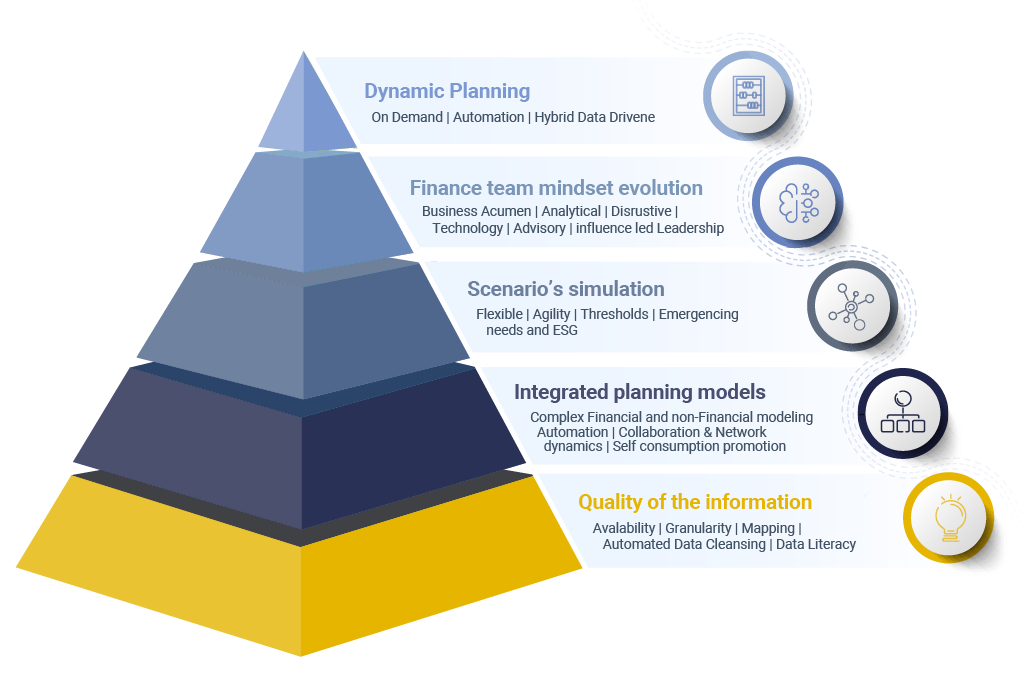

We help those ‘Driving Decision Making Professionals’ to champion the evolution in 5 areas:

• Ensure the quality of information: Continuous evaluation of data standards, data literacy across the organization, data cleansing automation, granularity adjustments, mapping.

• Integrated planning models: Powered by technological platforms that promote collaborative and network ways of working, incorporating company wide and external stakeholders (customers, suppliers, competitors, start-ups, administration …).

Where Planning Directors and Controllers play a critical role on promoting information self-consumption across the organization for them to evolve to a role more focused on modeling and insights advisory.

• Scenario’s simulation: Rapidly adapt to market changes through flexible, automated and scenarios that allow executive decisions to be made at any given time.

ESG being a great example of how new global trends require agile incorporation on complementary decision drivers on investment, financing, supply chain, compliance …

• Finance team mindset evolution: To meet the expectations on data mastery and analytical skills, increase technological competences, feature disruptive mindset whilst effectively leverage business acumen to advise on action plans, influence, communicate and lead.

• Dynamic Planning: Automated Planning based on algorithms and machine learning, achieving a process with minimal human intervention and where financial teams put aside their role as “data guardian” and focus on maximizing the benefits of data generated with greater precision and speed.

At NTT DATA we bring UNIQUE END-TO-END APPROACH and CAPABILITIES to partner with our clients in the evolution journey.

Some of our experiences involved helping a top european airline define and operates their Predictive Modeling for commodities and forex hedging. High volatility on fuel and forex, limited ability to action and limited information were eroding their ability to generate speedy decision making. By digitalization, optimization and automation of reporting hedging, data standardization and predictive model set up we were able to provide hedging recommendation and scenarios analysis based on risks assumption which finally leaded to enabling a correct budgeting based on portfolio performance.

NTT DATA accompanies hundreds of multinational organizations in every step of the Journey, from the design of the new model, the implementation, measurement of adoption to the Analytics AS a service provision, resulting in:

• Autonomy gains in generating budgeting cycles on demand.

• Unlink companies from structure and scheduled processes and be able to generate insights anytime.

• Have a more active role and become business advisors.

• Automated and integrated planning throughout the organization leveraged by an end-to-end process.

• Increased visibility and “actionability” based on data, scenarios modeling and reporting maximizing opportunities and mitigating risks.

• Execute enterprise-wide planning with ease using a high-fidelity, responsive, and unified source of truth.