When I started my own Green CFO journey, back in 2017, one of the main questions I was asking myself was: Is my passion for sustainability really connected to my professional finance career? Well, I recognize I found some setbacks on that journey. But I can say, with no doubt, that today the role of the CFO is key for any company who wants to succeed in terms of sustainability while keeping growth and profitability.

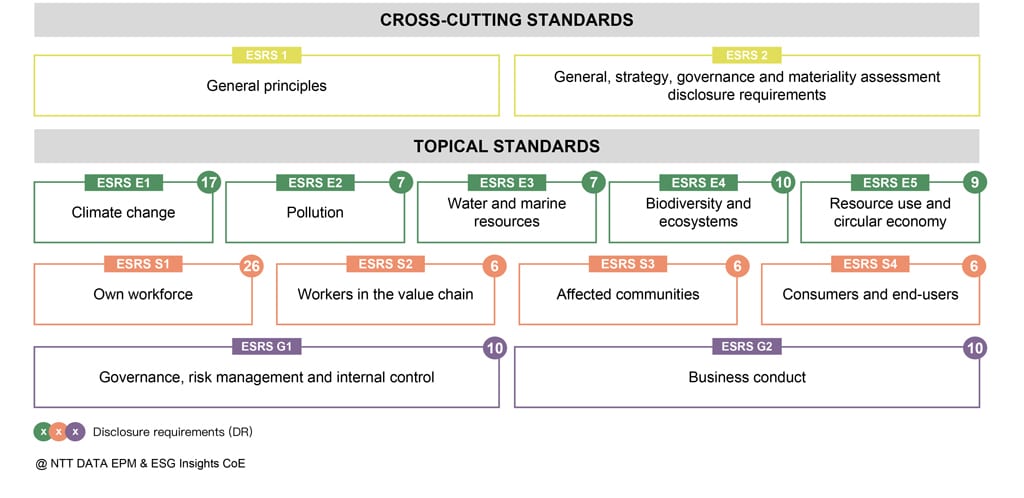

One of the most recent movements in the sustainability finance fields is related to ESG Reporting. Indeed, there is exciting news in this field because on April 21st 2022 the European Commission (EC) adopted the proposal for a Corporate Sustainability Reporting Directive (CSRD), setting compulsory reporting criteria on environment, social affairs, and governance for specific companies from 2024, with the publication of the ESRE (European Sustainability Reporting Standards) by EFRAG (European Financial Reporting Advisory Group).

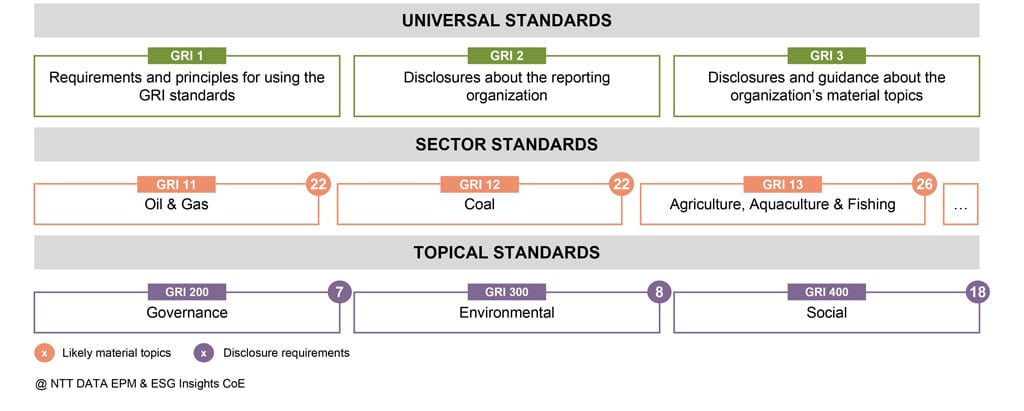

This adds to the already on development ISSB (International Sustainability Standard Board, established by the IFRS) and the GRI (Global Reporting Initiative, established by the GSSB, Global Sustainability Standards Board). The objective is that the reporting standards complement each other to deliver a more comprehensive sustainability reporting, that is comparable, transparent, and easy to understand by all stakeholders.

You will find below a status update on the three previous standards and a quick summary of the information to be reported, proposed by EFRAG, IFRS and the GSSB.

ESRS by EFRAG

These standards, expected to be released by the 31st of October of 2022, will replace the current NFRD (Non-Financial Reporting Directive) to provide additional disclosure requirements (DR), which focus on reporting on the company’s double materiality (disclosure of the impact of the ESG factors on the company’s value and the company’s impact on the economy, environment, and the people).

These differ from the rest in terms of scope, since the regulation will be limited to operations in the EU in order to be consistent with its ambitions, such as the European Green Deal, and its sustainability regulatory framework. Nonetheless, it will be compulsory for a bigger number of organizations than defined by the NFDR, which will have to start applying the standards in phases (to report on the following year):

- FY 2024: Large EU Public Interest Enterprises, which are already subject to the NFRD meaning the so-called “big companies”, large corporations that meet 2 of these criteria – +250 employees, +40 M€ revenue, +20 M€ on company balance.

- FY 2025: Other large enterprises that are not presently subject to the non-financial reporting directive.

- FY 2026: Listed SMEs, small and non-complex credit institutions, and captive insurance undertakings, although they will report following simpler standards.

- FY 2028: Non-EU companies with subsidiaries in the EU will also follow the simpler standards.

The reporting, in the future, will have to be certified by an accredited independent auditor, treated at the same level as financial information, even in terms of deadlines. For the time being, reasonable assurance suffices.

EFRAG will base its sector standards on the NACE system with reference to the EU Taxonomy, whilst IFRS will consider following SASB’s SICS system. This might present some challenges for multinational groups with operations in the EU.

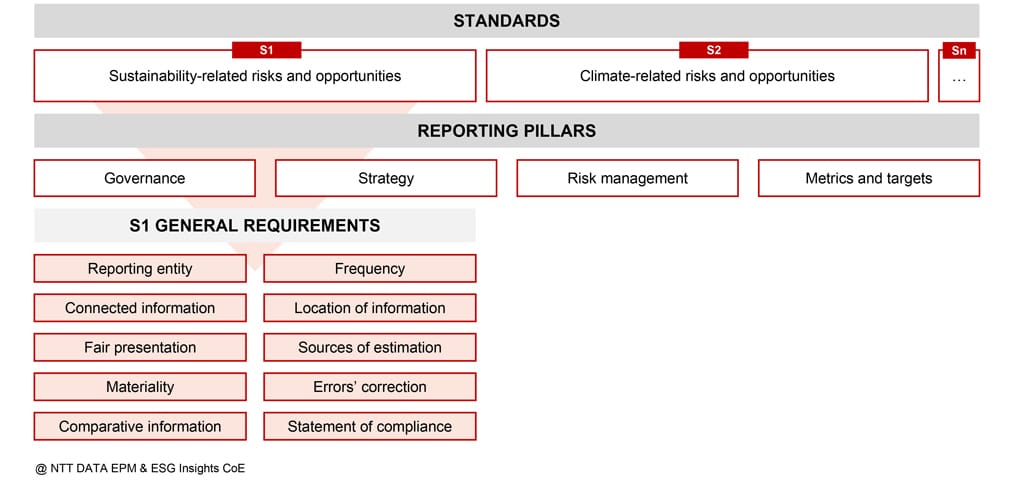

ISSB by IFRS

Back in March 2022, the ISSB drafted two standards – general sustainability and climate-related with specific disclosures based on industry – with the objective of standardizing and guiding sustainability reporting on an international scale and helping decision-making to achieve the company’s strategy. We are now at the redeliberation phase with the final standards coming out at the end of this year, 2022.

In comparison with EFRAG, the IFRS focused the drafts on a single materiality, mainly reporting the impact that sustainability has on the company. However, due to the raising prominence of the materiality concept, many have asked that the ISSB reconsiders the inclusion of the other side and broadens the user audience beyond the investors and other capital market participants.

An additional point of difference is that these are not compulsory. Although the jurisdictional authorities still have to decide whether to require their application, the investors and stakeholders’ expectations might encourage their application anyhow.

Standards S1 and S2 have already been published and the rest will start being published in the near future.

GRI by GSSB

Lastly, the GRI, developed and approved by the GSSB, is the oldest initiative out of the three, celebrating their 25th anniversary this year, with the guidelines’ release dating back to 2000 and with 73% of the world’s 250 biggest companies applying the standards. Their objective is to make businesses responsible for their impacts on society and the environment, therefore, focusing on the ISSB’s opposite materiality and reaching a bigger audience.

Even though the standards have reached high maturity levels, three-year work programs keep them up to date and ensure they comply with the rising requirements and expectations of the different stakeholders. Therefore, in 2019 the Sector Program was launched to require more detail to the companies based on their sector.

This year we have seen the updating of the Universal Standards to be reported by this upcoming January 2023, and the publication of the third sector standard – Agriculture, Aquaculture & Fishing.