everis helps organizations unlock the working capital trapped in their supply chains using an innovative financial solution based on digital transformation and dynamic discount

Although a relatively new concept in Spain, Supply Chain Finance has been around for decades. The Euro Banking Association defines it as “the use of financing tools and technologies to optimize management of working capital and liquidity invested in supply chain processes for trading partners”. In the current economic environment marked by accelerating disruption and change across every industry, this definition takes on particular relevance as more and more organizations turn to models involving SCF as a way to improve their working capital position and strengthen their balance sheet.

As supply chains stretch relentlessly across the globe, organizations are coming under increasing pressure to ensure timely access to liquidity, secure low-cost financing and minimize risk across the supply chain while improving supplier management. SCF is a solution that allows organizations to free up the capital trapped in their supply chains by combining invoice financing and early payment to both large and SME suppliers. This results in a win-win situation, since buyers optimize working capital and suppliers generate additional operating cash flow. By securing payments earlier, both improve their working capital position and can profit on their liquidity by spreading it across the entire supply chain.

SCF and Finance, strategically aligned

In a rapidly changing business environment, CFOs are being asked to go beyond the traditional role of managing and safeguarding company assets to drive business decisions and co-pilot digital transformation in their organizations. This requires shifting their focus from number crunching to reshaping the finance function by harnessing the potential of digital technologies and taking on a more proactive and strategic role in their organizations, in addition to deploying the necessary resources to structure and implement transformation plans across the board.

At everis we know that a cross-functional approach is needed to successfully pioneer that change and effectively align investment in new digital technologies with the business strategy and core finance function to drive supply chain transformation. Therefore, aligning Finance with the different areas of the business is a key factor to increase efficiency, effectiveness and profitability, and requires integrating different planning needs, analysis systems, methodologies and models:

- As a financial manager, you seek ways to profit on your solvency and release the cash held in your invoices. BilliB adapts to your financial strategy.

- As a purchasing manager, you need good practices and efficient tools in your relationships with suppliers.

- As a business person, you want to increase your profit while improving your relationships with suppliers and customers.

- As a payment manager, you want payment management to be as easy as possible, with optimized processes.

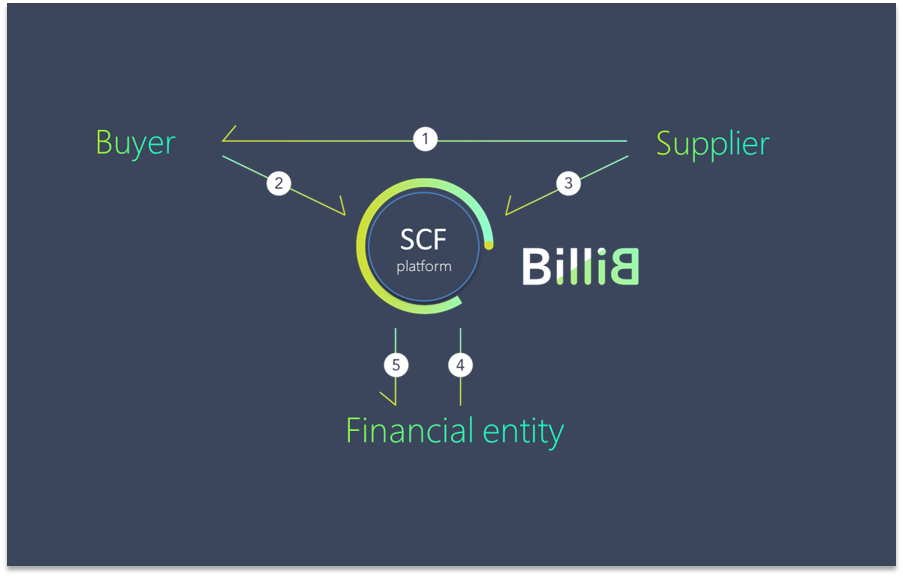

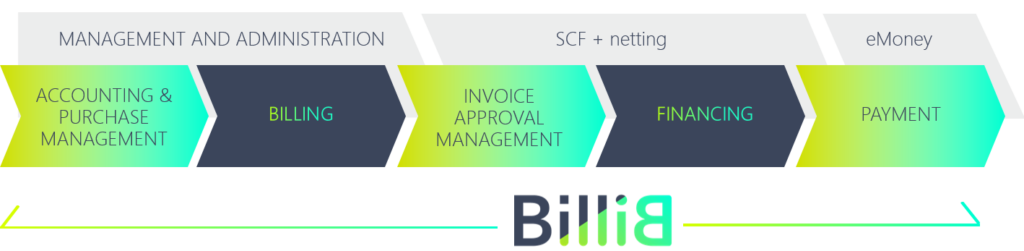

That’s why we develop BilliB and partnered with Bankia in Spain in a joint venture company. BilliB is an innovative global financial solution based on digital transformation which enables comprehensive, easy management of the entire financing and operating process —from invoice issue to payment— without the mandatory participation of a bank for funding, with the ensuing savings. It enables transparency between the companies using SCF and their suppliers and, since everyone is on the same platform, they will have instant access to the same information and visibility in terms of payments. It is also the only one founded on, and faithfully adapted to, Spanish law and tax requirements.

BilliB allows organizations to decide when, how and with what to pay its supplier invoices by providing them with a financial and technological platform which allows them to secure an influx of cash flow to meet capital allocation commitments by freeing up capital locked in the supply chain and offer advantageous supplier financing facilities that can lower margins and improve EBITDA. Likewise, it makes it possible to associate an electronic money account –eAccount or eMoney– with the customer’s bank account in order to optimize payment processes and unify their management thanks to the full traceability of each invoice.

It provides a ecosystem where buyers and suppliers integrate their purchasing processes under new relationship models and optionally with direct interaction with the financer (BilliB does not offer direct finance), enables the use of dynamic discount to facilitate early payment agreements and offers new working capital financing scenarios.

It is also quick and easy to implement, enabling full integration with SAP and lightweight, non-intrusive integration with ERPs to automate the entire O2C (Order to Cash) cycle between the ERP and the bank.

Ensuring Corporate Social Responsibility

Organizations are increasingly focusing on CSR and sustainable growth objectives by adopting new, more efficient payment and collection practices and tools that will allow them to optimize their working capital.

BilliB allows them to deploy different financial strategies while contributing to sustainable SCF by encouraging suppliers to adopt improved safety and labor practices through its Digital Treasury function. Aligning Treasury with SCF also makes it possible to effectively drive strategic Finance objectives, such as offering a more comprehensive view of cash and payments, and acquisition and capital allocation strategies.

BilliB also contributes to organizations’ corporate sustainability goals by facilitating the sustainable trade of goods by improving SCF services commonly used beyond our borders, encouraging them to practice corporate financial responsibility as a first step towards corporate social responsibility.

Case Study

Viesgo, a prestigious Spanish energy group founded in 1906 which engages in the generation and distribution of electricity, wanted to implement un SCF solution and they chose BilliB within its global digital transformation process and as part of its Supplier Relationship Management (SRM) model.

In a market situation with low interest rates, it is becoming increasingly difficult to obtain profitability. Therefore, as part of its commitment to the application of innovative technologies to financial processes, Viesgo wanted to implement a tool that would release profit locked in the supply chain in order to provide added value to your suppliers. In this regard, BilliB’s functional proposal allowed Viesgo to simplify, flexibilize and automate the entire supply chain management process through digital transformation and, ultimately, improve customer service. Financial disintermediation provides both economic and intangible benefits while allowing Viesgo to control working capital and plan resources more efficiently.

Although SCF tools are eminently financial, other departments also benefit from their adoption, such as Purchases, providing access to information on payment and billing processes which will allow them to negotiate better purchasing conditions. Therefore, a cross-functional approach towards a same goal was decisive in order to successfully implement a project that addressed strategic, economic and third-party collaboration objectives and required a joint effort between the BilliB team and the Purchases, IT, Accounting, Communication, Business and Treasury departments.

However, one of the greatest challenge to any supply chain transformation continues to be suppliers’ resistance to change, due to which greater awareness of the importance of digitizing finance is required in order to leverage the full potential of this solution in the electricity and energy sectors. This can only be achieved by understanding cultural resistance, evaluating where change is needed the most in order to overcome it to achieve the best results and designing an efficient Communication Plan.

Benefits of implementing BilliB

Financial Benefits | Corporate Benefits |

|---|---|

It increases EBITDA. The discount has a direct impact on this. | Get serious about your company’s digital transformation.

|

Use your own cash to get high profitability with zero risk (currently impossible in any other way without technologic support). | Time saved on invoicing and payment administration translates into significant savings. |

Use your credit access capacity to make extra revenue. | Profit on your suppliers while they thank you. It’s never been so easy to earn so much in a true win-win situation. |

Use your own post-financing to improve liquidity free of charge. | Help your suppliers while ensuring CSR, starting with corporate financial responsibility. By helping your suppliers you help society. |

Use BilliB to collect early, then use this income to pay early and get a supplementary return. | Reinforce your business image. Show your suppliers and their suppliers that you’re supporting the whole supply chain. And show your customers that you’re doing it. |

Plan your DPO (days payable outstanding) the way you want it. | |

Design the strategy you want, to improve your financial ratios. |