As a finance professional who wants to become a Green CFO your journey will surely evolve in different directions depending on your own experience and education, the industry of your current company or just your willingness to learn. Yet, my recommendation as starting point will be always the same: understanding the Sustainable Development Goals or SDGs.

Understanding SDGs is the best starting point if you want to become a Green CFO

You can find plentiful information about SDGs in the official webpage https://sdgs.un.org. As a quick recap, the 17 SDGs and their 169 targets were set up in 2015 by the United Nations (UN) as part of the Agenda 2030 and were established to be reached by that year. The ultimate objective of these interconnected goals is to achieve a “better and more sustainable future for all”.

On top of the good intentions and nice words what most people don’t know is that SDGs have started a true silent revolution in our society. Think in changes that happenned in our daily lives in most of development countries during the last years, for example: the rise of electric vehicles and the limitation of combustion cars into cities; the increase of maternity and paternity leave periods; the use of biodegradable bags or pay for plastic ones; the escalation of minimum wages; the surge of food with less sugar and the offers of gym discounts of some companies to their employees; the initiatives to collect second-hand clothes in some retailers; the increase of solar panels and other clean energy sources, the growth of ESG investments and their consequences to getting funds from banks, etc.

SDGs have started a silent revolution that is impacting our daily lives

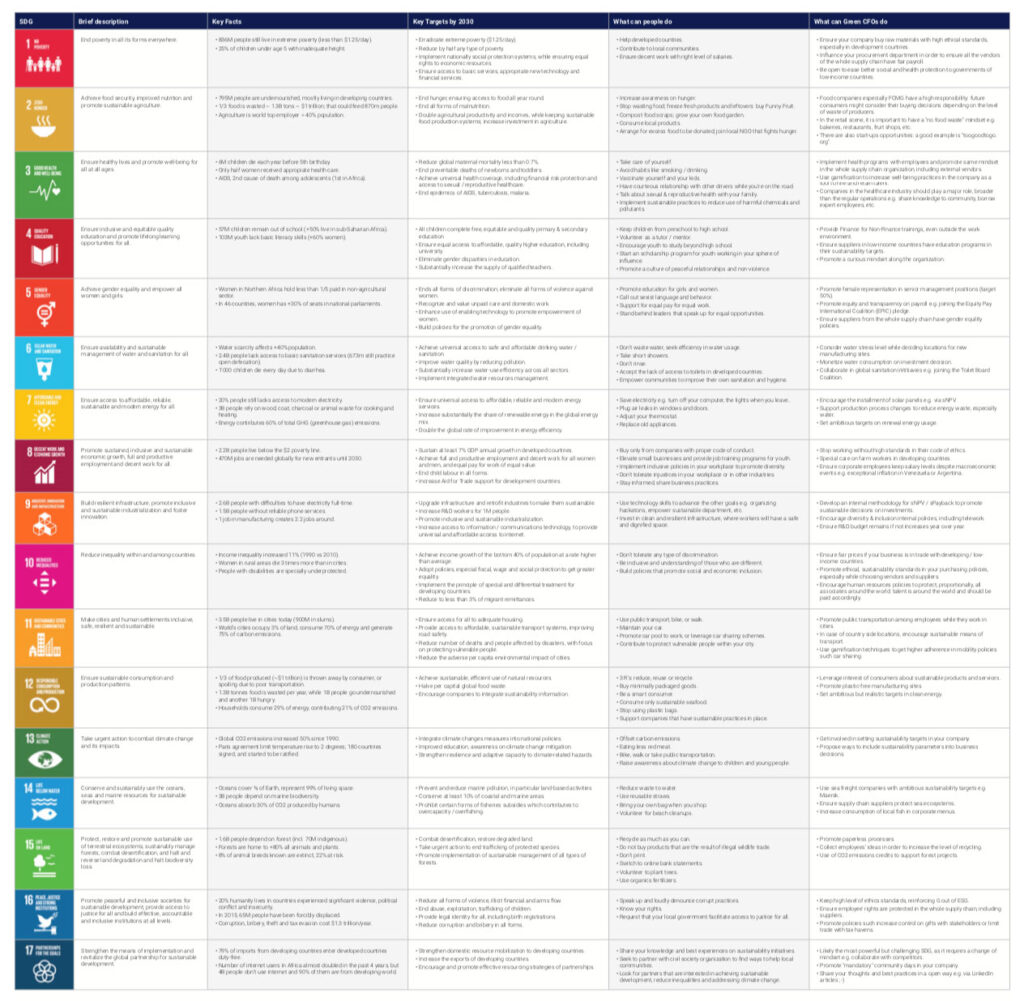

In the below attachement you can find a summary of the key facts that triggered the 17 SDGs, their key targets, and what can we do in both our personal lives and as Green CFOs.

A part of the wide information you can find above document I would like to share my Key Learnings while understanding the SDGs in order to maximize your knowledge:

- Deep dive with patience: there are many new concepts and a new vocabulary on sustainability terms that will require some time to digest. And remember that as long as sustainability be a pillar in your company’s strategy, understanding SDGs will be key to become a brilliant finance business partner.

- Focus in your industry: every company has their own priorities, so if you want to add value to yours you just simply need to connect the dots between the SDGs and the sustainability strategy of your company. If you don’t know where to start with take a look on what other industries are doing and try to replicate and adapt to yours.

- Have a futuristic view: the changes in the future regulations, for example in the so-called non-finance reporting, is a good example of how important is to anticipate similar changes. Using the logic behind SDGs you can act in advance to other companies in the same industry and gain solid competitive advantage.

- Connect SDGs and ESG: every single SDG can be connected with either Environmental, Social or Governance investment pillars, if not with 2 or the 3 of them at the same time. While Environmental must be the priority, once tacked is important to address Social goals as wells, because they will turn the most important ones in the short future.

- Break old rules: Starting by Milton Friedman’s theory and replacing “add value to the shareholders” by “add value to the stakeholders” as ultimate goal of every business, meaning obtaining good financial results while taking care of the planet and the society including employees and consumers.

I would like to finish this article mentioning what in my view is the SDG with higher potential; it means SDG #17 “Partnership for the goals”. The possibilities are huge in the idea behind the goal: collaboration to get better results, even with your competitors. We will see soon more a more partnerships between traditional competitors that join forces in order to attack a common enemy, for example in the textile or FMCG industries.