In the previous article, we reviewed the Sustainable Development Goals (SDGs) in order to get familiar with them while connecting the targets with the ESG framework. Although Social and Governance are very relevant in the mid-long term, companies are usually starting to manage their sustainability journey improving their environmental parameters.

Back in 2017, when I discovered the SDGs for the first time, I was very impressed by the magnitude and significance of the goals. Statements such “No Poverty” or “Zero Hunger” are strong, challenging assertions. Besides, my daughter was 2 years old at that time, so working in a job with a true purpose was even more important for me. It is in that context that I had an idea that I would like to share with you: create the sNPV (sustainability Net Present Value) in order to support investment decisions.

The implementation of sNPV (sustainability Net Present Value) will support companies to take sustainable investment decisions

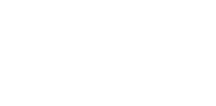

As you mighty know NPV stands for “Net Present Value” and reflects the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. The discount factor used in the NPV calculation represents how the value of money changes over time. It is the most detailed and widely used method for evaluating the attractiveness of an investment and for comparison purposes. In the below example, the table shows that the best investment decision is Project 2, because it has the higher NPV.

How does it work?

These are the recommended ground rules to implement sNPV in your company:

- The first thing is to involve your corporate finance function, if possible, the group CFO.

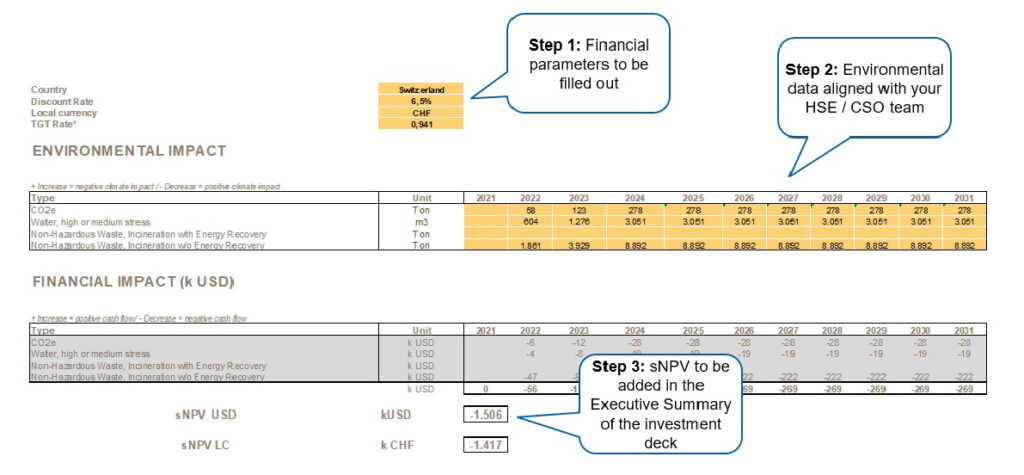

- Then, select the priorities in terms of environmental factors, for example, CO2 emissions (Scope 1 and 2), water consumption and waste disposal.

- Next, you need to find a financial equivalence (or shadow price) of every environmental factor unit. The WifOr Institute is a very good source. In the below case, for example, we used 100 USD for every CO2 tone.

- After that, you can create a template, for instance in Excel, to facilitate the Project Managers to fill out the investment information. For example, an equipment that is saving energy, and hence CO2 emissions, will have a favourable financial impact, and viceversa.

Other recommendations to successfully implement sNPV:

- Do not underestimate the impact of this change and the reluctance of some members of the stakeholders, including finance.

- Prepare a proper training involving all the project team participants.

- The sNPV is not designed to replace other financial investment figures, but to complement them.

- It is highly recommended to add the sNPV in the Executive Summary shown to the investment committee.

- The monetization and the logic of the calculation can be used in other investment financial KPIs such sPayback, sIRR or sROI. Please use the most important factor in your company for a better integration.

The idea to monetize the environmental impact can be a great first step to become a Green CFO. The potential of the logic is huge, as can be eventually use with other sustainability parameters such Scope 3 emissions, or even social indicators.