Companies that purchase commodities struggle to manage volatility risk and face uncertainty over results which is especially relevant for listed companies. Industries like airlines, FMCG, Manufacturing include commodities (Fuel, grain, metals…) that account up to 20%1 of their operating costs.

To lower volatility risk, hedging strategies have been traditionally put in place based on the purchasing of commodity derivatives which also adds a financial cost for the company (especially when prices move in a non-desired direction). This impact is amplified for non-dollar based companies as derivatives are usually bought in US dollars, which adds another risk of exposure to exchange rates.

Euro has devalued 60% in the last 12 years against the US Dollar and has shown periods of high volatility in the last two years.

On the other hand, the current context is adding economic pressure whilst providing great purchasing opportunities as many commodity prices are lower than ever.

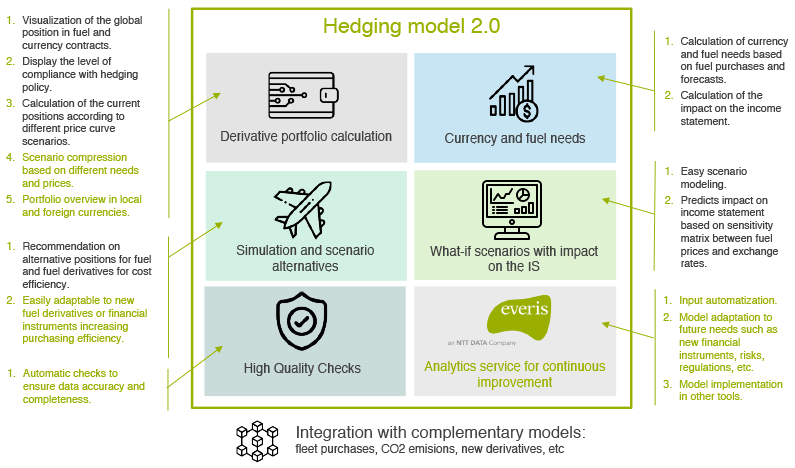

everis has developed a Hedging Predictive Analytics Platform (software & service) that helps predict future outcomes, gain flexibility, model uncertainty/future scenarios and improve reporting.

Benefits:

- One solution for all hedging dependent companies.

- Lower volatility risk with improved analytics.

- Up to 5% of savings capture in commodities hedging compared to peers.

- Greater Forecast accuracy with scenario modeling capabilities.

- Quick scenario elaboration to adapt to changes in context or assumptions.

- Greater control and compliance with hedging policies.

- Shorter reporting times.

- Greater transparency of the current portfolio and hedging strategy performance.

- Great flexibility and adaptability to business needs and derivative products.

- Quick implementation.

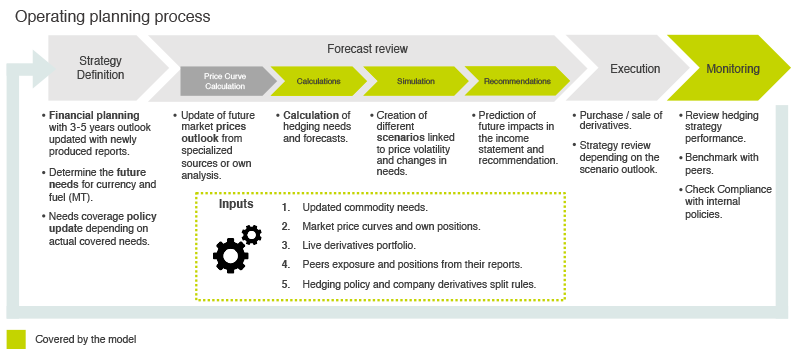

The model:

- Update commodity and currency needs based upon new scenarios and derivatives portfolio settlements.

- Simulate scenarios to determine P&L impacts.

- Determine commodities and forex thresholds of each scenario.

- Recommend operations.

- Clearly visualize all market positions for fuel and currency.

- Peer comparative (if data is reported).

Case Study - Fuel + Forex Hedging for a global airline

As the main source of Operating Expenses, Airline companies and especially Low-cost Airlines must manage fuel hedging adequately. And with hundreds of derivative contracts of different nature and of different products live every month, the business struggled to take the appropriate decisions: are we excessively covered or below the policy thresholds? If Brent price moves up 3%, what will be our overall position? Are we outperforming our competitors with our hedging strategy?

Following Agile methodology, everis developed a model adapted to Airlines business requirements with 4 modules and 2 embedded solutions:

Currency needs and fuel

Definition of currency need from income statement accounts

- Automatic calculation for currency needs and impact in the income statement with fuel settlement.

- Automatic calculation of income statement in dollars.

- Calculation of optimal split of trades among legal entities.

- Flexibility in the purchase / sale of currency derivatives anticipating future needs.

- Fast visualization of the changes in operations and impact on the income statement.

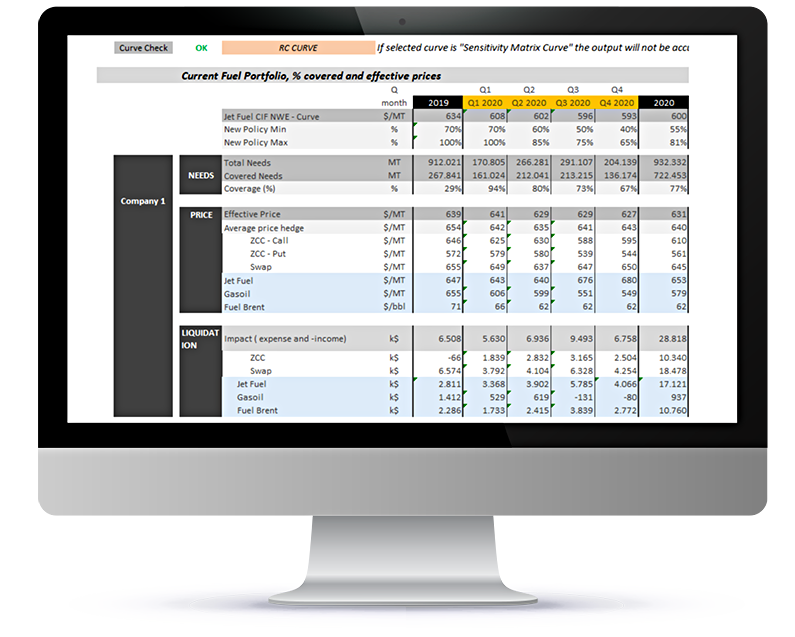

Derivative portfolio calculation

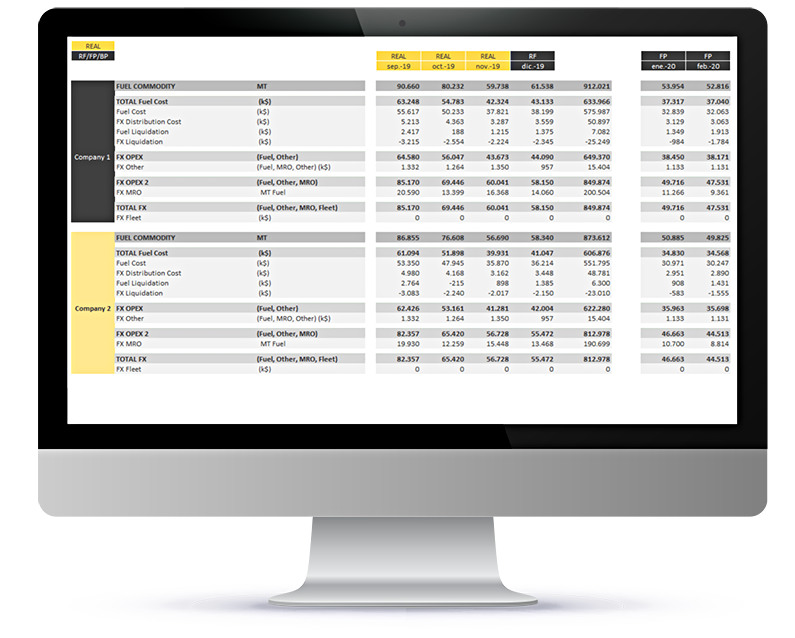

Complete vision of the current portfolio of fuel derivatives and currency exposure

- Fast access to life portfolio with all market positions for fuel and currency.

- Intuitive and clear visualization to facilitate operations.

- Peers comparative.

- Vision of current demand and to what % is covered.

- Settlement calculations against different prices curves.

- Average price calculations and effective price.

Simulation and scenario alternatives for fuel and currencies

Optimization of fuel purchases

Purchase proposals based on stock of complementary fuel products.

Ensure the compliance of hedge policy with the simulation of different scenarios.

- Capture savings by optimizing purchases.

- Identification of opportunities and other long term gaps.

What-if scenarios with impact on the income statement

Sensitivity matrix for fuel and currency price fluctuations

Automatic calculation of different impacts for different fuel and currency prices.

Fast scenario visibility and prediction of changes in the income statement.

Visibility of hedging impact on fuel invoice by measuring the effective price

- Calculation of operating result thresholds.

- Fast calculation of the income statement based on different fuel and currency prices.

Our solution has helped this Airline:

- Reduce reporting times.

- Gain control and visibility over the materialization of the hedging strategy.

- Lower operational risk.

- Capture savings in Fuel bill as well as for other relevant concepts.