Companies in the post COVID era are embracing digital transformation at a never seen rate in order to enable business growth and face the constant change of a digital ecosystem. Dynamic companies put their efforts to adapt their processes and tackle the challenges that the economic and also regulatory environment is bringing, together with the opportunities that go along with them.

Adaptation, adoption and agility as the key success factors of digital transformation are probably more relevant than ever due to the VAT in Digital Age (ViDA) reforms proposal that the European Commission published on December the 8th 2022. The project consists on a set of initiatives with the main goal of preventing tax evasion in the EU by embracing and promoting digitalization through a new tax reporting system and the general adoption of electronic invoicing (e-invoicing).

• Guarantee an efficient and fair VAT system for the digital economy.

• Ensure the proper functioning of the Internal Market of the EU.

• Fight against fraud, especially intra-community fraud.

• Simplify and adapt VAT regulations to the new digital reality of the market to facilitate tax compliance and offer greater legal certainty.

• Optimize tax declaration requirements thanks to digitization.

The VAT in the Digital Age (ViDA) reforms published by the European Commision are based on three pillars with the following 2024-2028 timetable:

- Single VAT Registration (SVR): based on the One-Stop-Shop (OSS) model, which simplifies the formal VAT obligations for any business, self-employed person or professional supplying services to end consumers in all EU Member States, these measures would allow companies to register in a single Member State for all the services they supply and to fulfill their VAT obligations through a single online portal.

The adoption of the existing One-Stop-Shop OSS VAT return to further B2C and B2B stock movements, is proposed for 2025. - Platform Economy: marketplaces or “electronic interface” in these sectors are set to be responsible for their EU-resident sellers B2C goods transactions from the 1stof January 2025, collecting and remitting VAT to the tax authorities where their suppliers do not. This will ensure a uniform approach, introduce a more level playing field with non-EU sellers’ transactions, as the changes apply to EU and non-EU resident marketplaces, and simplify things for SMEs.

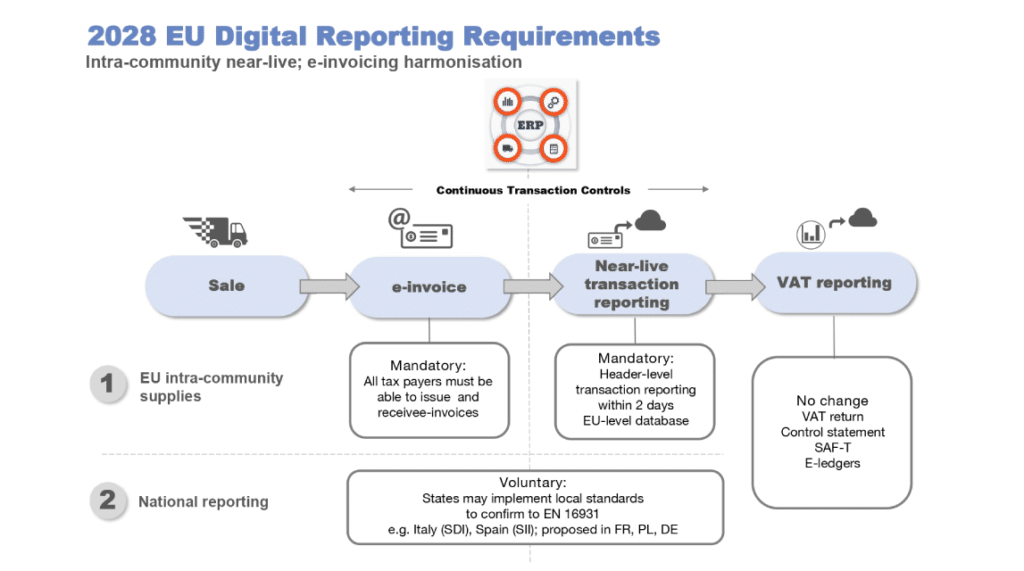

- Digital Reporting Requirements (DRR): A new real time digital reporting system based on e-invoicing in order to provide valuable information to businesses will be mandatory from January the 1st2028. All businesses undertaking intra-EU B2B supplies will be required to issue and receive e-invoices and report these transactions within two days of issuing the invoice. Digital Reporting Requirements can be divided into the following:

- Periodic Transaction Controls, like the Standard Audit File for Tax (SAF-T), a file type based on the XML standard used internationally for the electronic exchange of tax information.

- Continuous Transaction Controls, which mean real-time reporting or mandatory e-invoicing.

This last requirement and the corresponding European standard on e-invoicing (EN 16931) developed and published by the European Committee for Standardization (CEN), can be considered the one reform with the most impact for companies in terms of investment and time to implementation.

On the subject of e-invoicing, ViDA basically states the following:

• The electronic invoice will be the default method for invoice issuing (mandatory for cross-border transactions) and electronic tax declarations.

• Member states will be able to impose B2B electronic invoicing without the need to request an exception from the European Parliament.

• A common electronic invoice standard will be established.

• The exchange of electronic invoices will no longer be subject to the acceptance of the recipient.

• The possibility of issuing summary invoices will be eliminated.

The reforms, once enacted, will require businesses to submit real-time transactional data to tax authorities, and should call for a strategy focused on the life cycle of the transaction compliance process.

Although EU member states must still unanimously approve ViDA, regulations are expected to come into force in 2024-28. This is already having an impact on many countries and those with existing e-invoicing regimes, such as Poland, Italy and France, who are updating them to comply with ViDA. Others, including Belgium and Spain, are actively discussing e-invoicing requirements with plans to accelerate implementation as of 2024.