In recent times, the business agenda has been marked, among others, by the following major trends:

- Increased market concentration and competition that reduces margins.

- Increased uncertainty with major unforeseen crises (pandemic, war in Ukraine) that have forced critical decisions to be made in a short period of time.

- High inflation impacting costs with difficulty in passing them on to the customer.

- Increased awareness about sustainability by the different stakeholders (e.g. investors, banks, customers, workforce).

- Efficiency in transactional tasks that do not generate differential value for the business by adjusting their costs.

- Focus on the generation of agile and accurate information for business decision making, financial and non-financial.

- Fewer and highly knowledgeable professionals with superior ability to anticipate business needs and drive business insights out of data.

- A network of expertise that delivers flawless operations powered by a hybrid workforce: People + Generation R (robots/virtual assistants) + Generation A (algorithms).

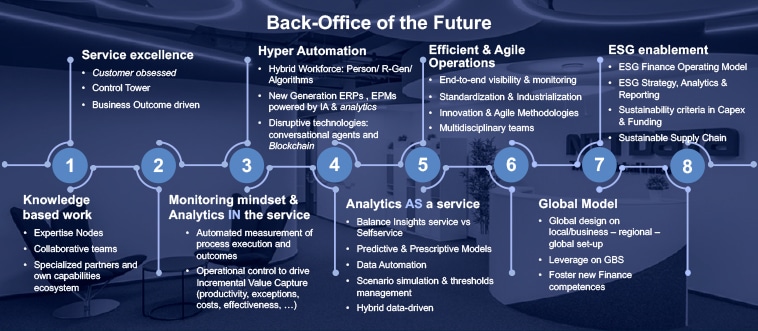

- Service excellence: evolution from an on-demand service to a more structured service model based on demand management, predefined and scheduled deliverables, self-service by business and the monitoring and measurement of KPIs and SLAs. In a major manufacturing company we have been able to calendar in a self-service model around 70% of the final deliverables of the finance department, increasing the productivity by 20%.

- Knowledge based: team with expert knowledge that anticipates needs and drives their implementation through collaborative networking models.

- Hyper automation: objective to achieve the maximum percentage of automation of recurring tasks, both in the administration and accounting area (new ERPs + Robots) and in the controller’s area (EPM + Analytics). Best practices of the market suggest an automation of up to 80/90% of the recurrent tasks.

- Monitoring mindset & analytics in the service: automation of processes and focus on monitoring their execution, in order to identify improvements in service quality and identify value capture bags (efficiencies, productivity, etc.). For example, a global Pharma company was able to save ~ 70 million euros in working capital applying process mining to OTC process.

- Efficient & Agile operations: agile work methodologies with partial and incremental results both for the BAU of the business and for the transformation tasks of the area, adapting this methodology to the particularities of the finance area (e.g. respecting the time reserved for month-end closing). By means of example, we have seen a major Telecom corporation achieving an increase of 10% of the productivity by setting up a more “liquid” organization, sharing non specialist resources among different finance areas (P2P, R2R, fixed assets and OTC).

- Analytics as a service: leverage on advanced analytical models for the generation of predictive and prescriptive models, freeing up time for information analysis and speeding up the time it takes to make information available to the businesses. For example, a Technological leader company has been able to automate the rolling- forecasting process, increasing the accuracy (+96%) and going from 150 people performing the process to less than 5.

- ESG enablement: incorporation and traction of the company’s sustainability objectives through two areas:

- Generation of non-financial reporting, both to the market (different stakeholders) and with an internal vision to align operations with the strategy.

- Incorporation of sustainability impacts in the CAPEX analysis to ensure the achievement of ESG objectives in the medium/long term.

- Global model: design of a global and unique model for the provision of the service with the necessary regional/local capabilities.

From NTT DATA Digital Finance, we help finance departments to identify and drive the different transformation levers with an end-to-end vision from the conceptualization to the implementation.