The financial landscape is undergoing a profound transformation, thanks to the infusion of Artificial Intelligence (AI) into financial management. For Chief Financial Officers (CFOs) and finance professionals, this technological revolution is reshaping accounting processes and providing new avenues for efficiency and insights. In this article, we explore the current state of AI in finance, highlight specific AI tools like Robotic Process Automation (RPA), and delve into how NTT DATA is partnering with Anaplan to bring valuable AI benefits to CFOs.

The Rise of AI in Financial Management

AI is playing a pivotal role in enhancing financial management for CFOs and organizations. It is not merely about automation but also about improving decision-making and providing predictive analytics.

AI Tools in Financial Management

Robotic Process Automation (RPA): is revolutionizing the finance sector. For example, RPA bots can be programmed to automatically reconcile bank statements, or automate invoice processing and reconciliation, reducing manual effort and errors. RPA solutions transform routine tasks, such as data entry and report generation. This allows finance teams to allocate more time to strategic financial planning and analysis.

Machine Learning (ML): ML algorithms are used to analyze historical financial data, detect anomalies, and predict future trends. CFOs can use ML models to improve cash flow forecasting, manage risk, and optimize investment portfolios. It is also being used to accurately anticipate, revenue and expenses, enabling proactive budgeting and resource allocation. ML models can be trained as well to flag unusual accounting discrepancies and suspicious transactions, strengthening internal controls and fraud prevention.

Natural Language Processing (NLP): NLP technology can extract valuable insights from unstructured data sources, such as news articles and social media, to help CFOs make informed decisions. Thus, it enhances risk management, helping to identify and mitigate potential risks from market fluctuations, credit defaults, and fraudulent activity. Tools like Lexalytics and Ayasdi are used for sentiment analysis and risk assessment.

Personalized Financial Insights (AI-PFI): AI-PFI tools utilize machine learning and data analytics to provide individuals with personalized financial advice and insights. This is essential for financial management as it allows CFOs to tailor financial strategies for specific stakeholders or departments within the organization. This not only enhances decision-making but also fosters a deeper understanding of individual financial needs and objectives, aligning financial strategies more closely with the organization’s overarching goals.

NTT DATA and Anaplan: Enhancing CFO Value with AI

NTT DATA, in collaboration with Anaplan through its Enterprise Solution Advisory Team (ES), is actively working to unlock the potential of Anaplan’s Enterprise Performance Management (EPM) capabilities. Anaplan has emerged as a leading cloud-based planning and performance management platform, drawing significant attention within the finance sector and beyond. What truly distinguishes Anaplan is its innovative connected planning structure, a cornerstone of modern financial management.

Connected planning enables organizations to break down traditional planning silos, fostering collaboration and real-time data integration across various departments. For CFOs, this interconnectedness is invaluable as it ensures that financial planning is aligned with other critical aspects of the business, such as sales, operations, and workforce planning.

Connected Planning Honeycomb Effect

Anaplan’s integration of AI within its financial module, operating within this connected framework, further elevates the value it brings to financial management. This augmentation is achieved through a suite of advanced tools:

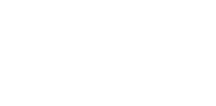

Advanced Forecasting: Anaplan harnesses the power of Machine Learning (ML) to significantly improve forecasting accuracy, empowering decision-makers to make more precise judgments related to budgeting and resource allocation.

Embedded statistical and AI/ML-based forecasting

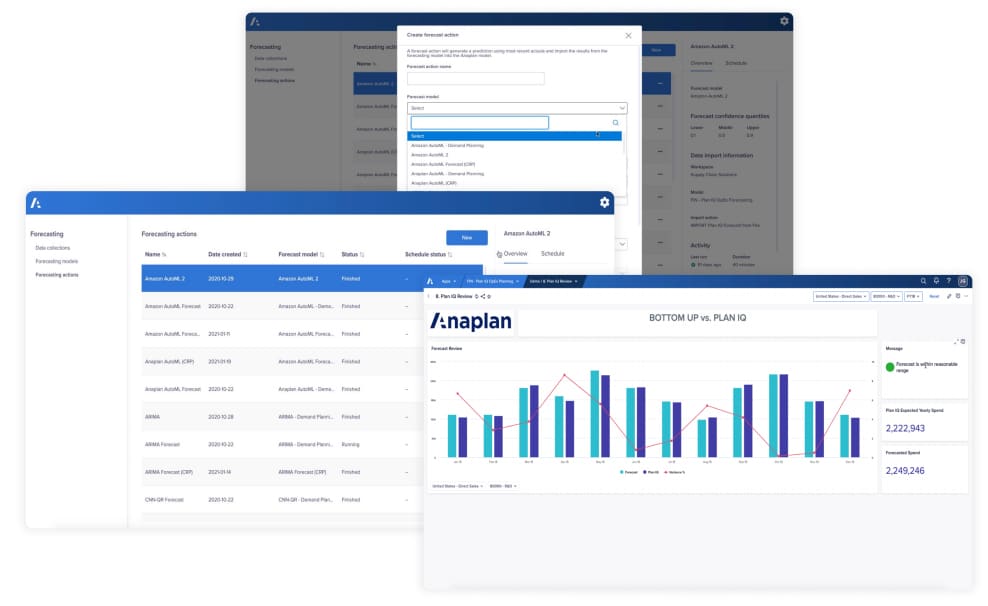

Scenario Analysis: The platform’s AI-driven scenario analysis aids CFOs in assessing a range of financial scenarios and understanding their potential implications on the organization’s bottom line. This capability is particularly valuable for proactive risk management.

What-if analysis, drill-down capabilities, and constraint-based planning

Efficiency Enhancement: Robotic Process Automation (RPA) is at the core of process optimization within the Anaplan platform. By automating routine tasks and reducing manual errors, it empowers finance teams to redirect their efforts toward strategic initiatives, fostering overall operational efficiency.

Real-time Insights: Natural Language Processing (NLP) technology underpins Anaplan’s provision of real-time insights and data visualization. This capability equips finance professionals with a comprehensive overview of their organization’s financial health, facilitating more informed and timely decision-making.

Embrace the Transformation: The Time is Now

Through these capabilities, NTT DATA and Anaplan are actively enhancing the value proposition for financial management, offering a comprehensive solution that not only aligns financial planning with broader organizational goals but also empowers finance professionals to navigate the ever-changing financial landscape with confidence and precision.

The revolution is undeniably underway, and the imperative to act is pressing. By embracing AI and proactively addressing its associated challenges, finance leaders can emerge as architects of a smarter, more efficient future for their organizations. It is time to embark on a journey of exploration and experimentation, harnessing the power of AI to usher in a new era of financial management and accounting. In this dynamic landscape, insights will drive decisions, automation will liberate untapped potential, and data will illuminate a clear path to sustainable growth and lasting success. The transformational potential is immense, and the moment to seize it is now.