In the same way that incomparable and unclear financial reporting in the pre-1929 crisis era led to the creation of the US GAAP, sustainability reporting has been facing a similar situation. Reporting under various frameworks such as the GRI and SASB has resulted in differing visions, hindering comparison, and raising accuracy concerns. In response, EFRAG (European Financial Reporting Advisory Group) has introduced the ESRS (European Sustainability Reporting Standards) under the approved CSRD (Corporate Sustainability Reporting Directive), providing a much-needed structured framework to navigate sustainability and corporate requirements.

ESG reporting, however, transcends from being merely a regulatory requirement and reputational advantage. It drives financial performance, enhances operational efficiency, and presents an opportunity to tailor the company’s strategy to its unique risks, challenges, and opportunities. It accelerates companies’ ESG ambitions, facilitating more conscious and strategic decisions based on actual and accurate data.

The question that now looms large is: how can businesses effectively transition?

CSRD reporting adaptation methodology

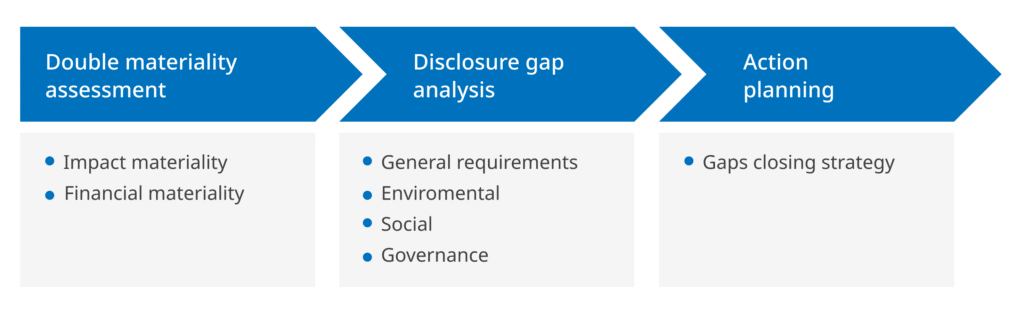

The CSRD reporting adaptation methodology unfolds in three pivotal phases that can be somewhat overlapped in a timeline: double materiality assessment, gap analysis, and action planning. The sequence of these phases depends on the company’s priorities and sustainability strategy, allowing flexibility in their approach.

The initial steps involve conducting a double materiality assessment, which demands careful coordination between stakeholders, and whilst not uber complex it can be long. This assessment, rooted in CSRD topical standards to ensure efficiency and precision in analysis, differentiates from previous non-financial reporting standards, emphasizing the dual evaluation of ESG issues based on both their impact and financial significance. Results indicate the number of material requirements that will need to be reported.

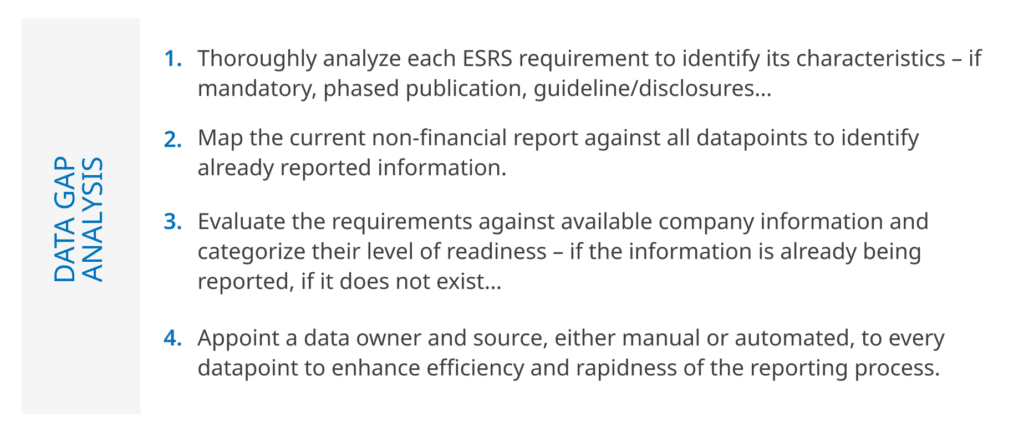

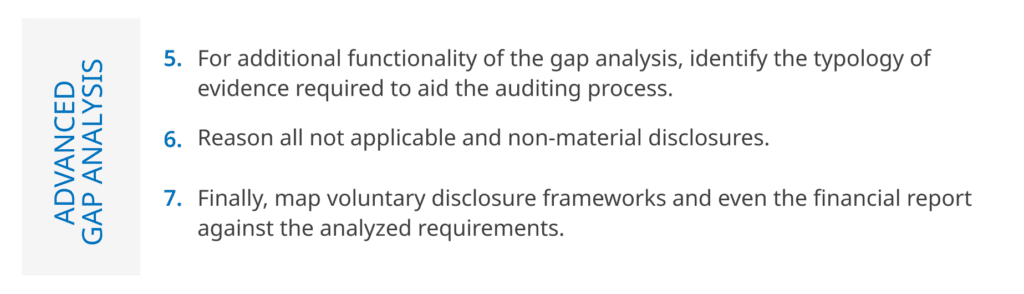

Simultaneously, if possible, businesses embark on a thorough disclosure gap analysis. The gap analysis, varying in complexity, assesses ESRS requirements against the current report and existing company data, identifying information gaps. Advanced gap analysis extends to transforming the analysis into a tool that can serve different functionalities – as an active repository, as evidence during the auditing process… Additionally, the ESRS can be mapped against voluntary disclosures’ requirements such as the TCFD (Task-force on Climate-Related Financial Disclosures) and CDP (Carbon Disclosure Project), along with the company’s financial report, to leverage efforts on common datapoints and streamline overall reporting processes.

Based on the results of the double materiality assessment, only material requirements should be included in the gap analysis, however, it is advised that all data points are analyzed to ready the information in view of all emerging sustainability regulations and voluntary disclosures, not only at European level but also at national and international level.

Once the analysis concludes, companies design an action plan to bridge information gaps, prioritizing imminent and mandatory requirements due to the efforts required.

NTT DATA aims to ease this changeful reporting process and has developed an accelerator that identifies the preparedness and maturity level of companies and streamlines CSRD adaptation. This tool encompasses all mentioned functionalities, aiding companies in creating a compliant and strategic sustainability report in a standardized manner.

CSRD requirements: continuous adaptation

A notable requirement under the CSRD mandates obtaining external limited assurance on all disclosures, methodologies, and electronic tagging, ensuring accuracy, transparency, and compliance. The EC (European Commission) is still deciding if assurance will move from limited to reasonable in the future, so changes are expected.

The introduction of an ESRS-based digital Taxonomy in XBRL format in 2024 adds another layer of complexity. With public consultation starting during the first quarter of next year, this taxonomy will help reports’ users to analyze and comprehend information in a structured, error-free, and machine-readable data format. Companies are advised to advance on their digital tagging preparation following the publication of the List of ESRS datapoints – Implementation Guidance to anticipate forthcoming changes.

Additionally, sectorial standards will be published during the next years identifying and prioritizing key sustainability matters based on the defined sectors’ business activities. It will be a long journey as complete standards development cycles might take up to 24 months, and the EC has asked the working group to prioritize the finalization of the sector agnostic ESRSs. Nevertheless, the first sectors that will be published are Oil and Gas, Coal, Quarries and Mining, and Road Transport.

EFRAG is helping ease this transition by releasing pertinent documentation. Up to this day the following helpful documents have been published, with more expected to follow:

• (Draft) List of ESRS datapoints – Implementation Guidance(published): Datapoints from ESRS General Disclosures 2 – ESRS G1 to help with the gap analysis.

• ESRS vs GRI commonalities(to be published): Common datapoints between the two standards to help companies identify the synergies between both.

Digitalization of ESG reporting processes

Finally, current manual collection and reporting methods have proved time-consuming and error prone. Driven by the need for efficiency, data quality, and networks collaboration, it is now a timely moment to digitalize and automate the reporting processes due to two main factors:

- The ESG reporting process has reached a level of maturity since the publication of the Spanish EINF 2018 Law.

- And, the ESRSs have been published to become a foundation for consistent practices.

NTT DATA stands ready to assist companies embark on digitalization initiatives, leveraging its accelerators, in-house talent, and strategic partnerships to enhance agility and deliver superior outcomes in their ESG reporting processes.

Navigating the future with confidence

In this dynamic landscape of regulatory compliance and sustainability, businesses find themselves at the intersection of regulatory rigor and strategic innovation. As the CSRD sets the stage for a new era in ESG reporting, companies must not merely adapt; they must evolve.

NTT DATA helps businesses navigate this CSRD journey of strategic foresight and innovation by providing them with all necessary tools to embrace the future with confidence, making sustainability a cornerstone of their enduring success.