Under the ViDA initiative (VAT in Digital Age), the European Commission is introducing a series of reforms that will revolutionize how financial transactions are managed between companies in the EU, making tax compliance seamless and minimizing the existing fraud so that the business ecosystem will operate on a more transparent basis to tax authorities.

In order to achieve these goals, the introduction of Continuous Transaction Controls is the most important reform included in the ViDA initiative and together with the Periodic Transaction Controls they constitute the new Digital Reporting Requirements (DRRs), one of the three pillars on which ViDA is based as explained on a previous article.

What are Continuous Transaction Controls (CTCs) and how are they relevant for tax compliance?

The requirement refers to mandatory transaction data reporting and its verification by the tax authorities via e-invoice or transaction listings in real or “near real” time. This reporting grants the tax administration to collect data on-line from the companies about all the business transactions taking place and allows comprehensive records to be used for VAT compliance supervision in order to improve tax collection, tackle the problem of tax evasion and therefore, reduce the existing fraud of VAT in the EU.

In summary, with CTCs tax authorities on every EU country gain insight into transactions liable for taxation in a more accurately and timely manner than with the current controls established in the EU, reducing the gap between the VAT expected and the actually collected. By monitoring business transactions actively, the discrepancies between VAT reporting and payments is reduced.

Existing and proposed CTC models

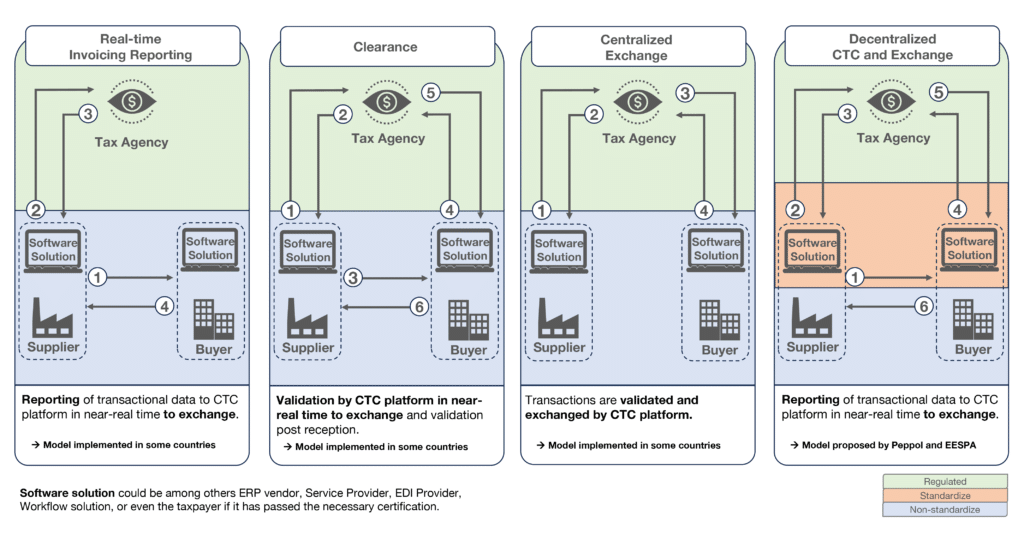

CTCs are already implemented in several countries under different models that basically allow data transaction to be submitted to a tax authority platform either before, during or immediately after the supplier sends an invoice to the buyer.

Under already existing centralized models, companies have to clear every e-invoice via a tax agency platform before sending them to the buyer. These current models favour the tax authorities but not the average business, as mandating electronic invoicing is not enough for businesses to transition and benefit from full business automation when the tax authority is put in the center. On the other hand, in a decentralized model, suppliers are allowed to issue e-invoices to buyers directly but must simultaneously send reporting data to the tax authority.

The existing CTC models are specific to each country due to small variations from design to implementation level and can be generally grouped into the following categories, including a proposed decentralized model by a group of global e-invoicing stakeholders like Peppol (Pan-European Public Procurement Online) and EESPA (European E-invoicing Service Providers Association):

Real-time Invoice Reporting Model

Used in countries like Hungary and South Korea, where the taxpayer reports the invoice, or a subset thereof, to the Tax Administration or a government agency acting on its behalf shortly after the issue and exchange of an invoice between the trading parties. The key features are as follows:

• A central processing platform is established by the Tax Administration, requiring the use of accredited software solutions for access and processing.

• Taxpayers submit the invoice itself, or a subset of invoice data within 24-72 hours of invoice issuance with variations as to frequency intervals.

• The system is mandatory for larger economic operators and MNCs but is extensible to SMEs.

• The submitted dataset could be generated fully from data in the invoice, or the submitted dataset requires data not available in the invoice.

Clearence Model

Used in countries like Chile and México, this model provides invoice clearance (fiscal validation and approval) before or after issue of the invoice to the buyer. Clearance may be provided by a central platform or through a network of accredited service providers. Invoice and related document exchanges takes place directly between taxpayers/economic operators, with or without the support of service providers. These latter processes are not regulated by government. The key features are:

• A central data repository and platform is established by the Tax Administration, who specifies a structured invoice format to be used by taxpayers.

• The supplier submits the invoice to the designated platform hosting the central data repository to obtain clearance (fiscal validity) of the document and after obtaining validation from the platform, allows the supplier to send the validated invoice to the buyer. The buyer validates the invoice to the designated platform by acknowledging its validity prior to payment.

• These processes will be different if the clearance process is delegated to accredited service providers.

Centralized Exchange Model

Used in countries like Italy and Turkey, this model may be an additional feature of the Clearance Model or a model which, for example, supports public procurement. It is provided by government and replaces the direct exchange of documents between the economic operators themselves for the defined circumstances. The exchange functionality may be used for only B2G (Business-to-Government) transactions or for both B2G and B2B transactions. The key features are as follows:

• A central platform or network is established by a government agency through which E-invoices are exchanged between buyers and sellers.

• The central platform may integrate with the Clearance Models by having the right to fiscally validate transactions.

• There are variations, for example by offering connectivity to widely available interoperability networks to support both domestic and non-domestic flows.

Decentralized CTC and Exchange Model (DCTCE)

The DCTCE model is a combined effort proposed by key e-invoicing stakeholders around the globe who seek for 100% interoperability and full business automation. This model would provide business automation, while still allowing the tax authority to obtain the needed VAT information and therefore, balancing governmental and business needs. The key features of this model are:

• Data validation and exchange is performed by certified service providers, not by a central platform. Businesses choose their service provider, which is certified by the tax authority.

• All certified service providers need to adhere to predefined minimum technical standards, to ensure system interoperability but can use other agreed standards outside the regulated standards zone for tax reporting and clearance.

• This model allows economic operators to leverage existing investments in interoperability, and Electronic Data Interchange (EDI), and also allows governments to leverage existing core investments in Tax Administration platforms and in public procurement platforms instead of building from scratch.

• Only a subset of the exchanged business document, e.g., invoice, need be submitted to the central platform (data minimisation).

• The submission of the data subset takes place instantly after the issuance and exchange of the business document (uninterrupted supply chain).

Some European countries have been adopting CTC in recent years, like Italy, where CTCs have been a requirement for all domestic transactions between Italian residents or businesses since 2019. Starting on 2024, France will require e-invoicing and e-reporting for all B2B transactions (including international) and B2C. To generate and exchange electronic invoices, businesses will have to utilize either a central e-invoicing platform or connected service providers so a centralized and decentralized CTC models will coexist.

Spain has made significant progress towards mandatory e-invoicing in recent years, with two e-invoicing platforms in place: FACe for B2G e-invoicing (mandatory for central government and optional for regional and local governments) and FACeB2B for B2B e-invoicing. The electronic invoice requirements for B2B transactions established in the draft law 18/2022 or “Crea y Crece” will drive the expected 2024 timeline for adoption of CTCs in Spain after closing its public consult back in July.