Combining two advanced analytics models to improve accuracy in cash flow planning: optimizing debt collection in the short term and cash position forecasting in the long term

The need for a more effective, customer-focused collections process is fast becoming a priority for companies seeking to improve debt recovery, reduce collection costs and maximize resources. Badly assessed financial risks fueled by inaccurate cash flow forecasts and ineffective debt collections processes can expose companies to business failure due to late payments.

To prevent this worst-case scenario, Advanced Analytics and machine learning algorithms offer companies new technologies and customer segmentation-based approaches to improve their debt collection strategy.

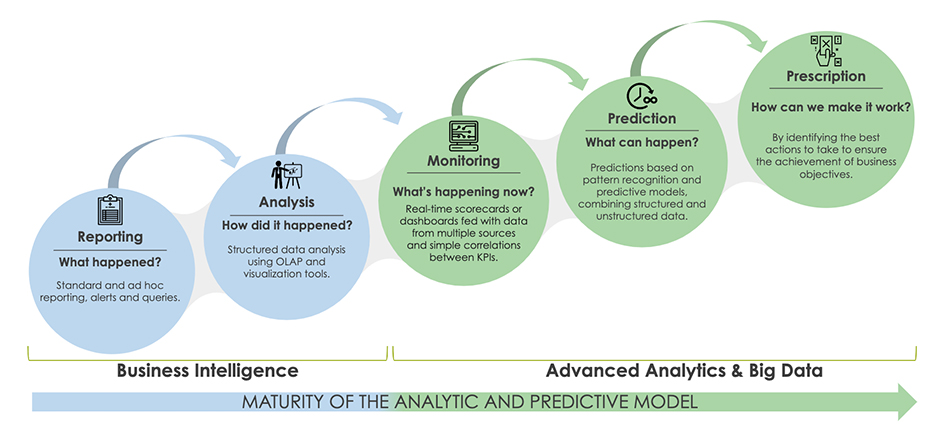

From Business Intelligence to Advanced Analytics & Big Data

While traditional Business Intelligence is a reality at most companies, there is a growing need to embrace digital technologies based on artificial intelligence and machine learning to build intelligent data analysis systems.

Although this new reality represents a challenge for companies, at the same time it opens up new analytical possibilities that will allow them to evolve from traditional financial reporting and analysis to a data-driven model based on monitoring, prediction and prescription.

In order to help model and forecast the probability of what might happen, prescriptive analytics is the area of business analytics dedicated to finding the best course of action or outcome for a given situation with known parameters in order to make specifically targeted, timely interventions.

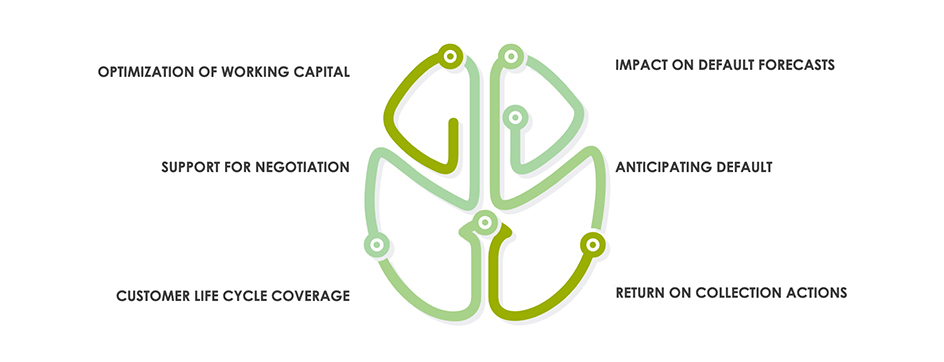

HOW ADVANCED ANALYTICS HELPS IN THE COLLECTIONS PROCESS

everis strategically integrates next-generation analytical tools into its Finance solutions offering to help companies gain insight into critical customer data and capitalise on that insight to build predictive models based on behavioral segmentation, allowing them to anticipate potential problems by making financial patterns apparent and actionable.

Challenges

In this scenario, the collections process is critical because it directly affects the company’s probability of debt recovery and treasury planning.

Therefore, accurate forecasting becomes a fundamental pillar of the business and requires the design and implementation of a solution that effectively addresses the shortcomings that many companies address in this process:

- Lack of traceability in the collections management process.

- Little margin for collections management before the reporting date.

- High manual effort.

- Management of information outside the ERP.

- Large number of casuistries per client.

- Interdependence with other processes.

- Limited data = difficulty to identify behavioral patterns / inaccurate forecasting.

- Many internal and external variables.

- Adverse effect on the company’s performance and bottom line.

everis proposes a hybrid, predictive analytics-driven model built into user-friendly dashboards to help companies tackle these challenges:

- Predictive Model (Invoices)

- Global Forecasting Model (Collections)

Make accurate long-term treasury estimates using forecasting models that combine internal company information on customers and suppliers drawn from the short-term predictive model and ERP with external macroeconomic information.

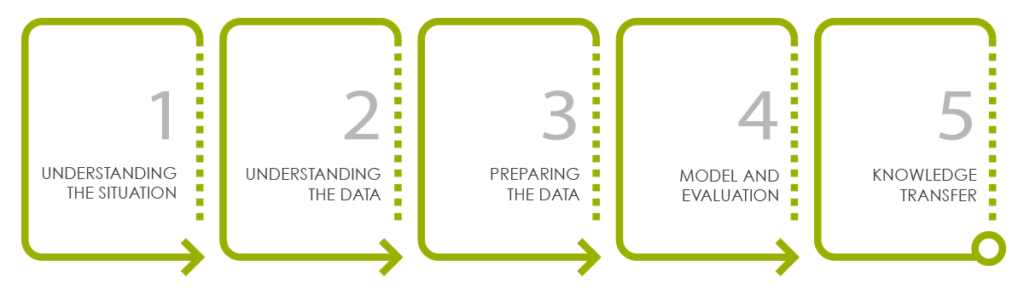

everis Analytics Project Methodology

In order to achieve this, we must design a work plan that will allow us to identify and organize all the tasks that must be completed to define, capture and process the necessary information to implement an intelligent data system. This includes defining the requirements of analytical and predictive techniques to generate reliable forecasts that will anticipate the probability of collection, in addition to the functional and technological tools that will enable end users to exploit and visualize historical and predictive information.

This will be undertaken in the following project phases:

Phase 1: Understanding the situation

Understanding the project objectives and requirements to convert the knowledge acquired into a Data Analytics problem:

- Meetings to understand detailed aspects of the business relevant to the project.

- Meetings to discuss the available data sources.

- Data extraction.

Phase 2: Understanding the data

Initial data collection and quality analysis using descriptive and exploratory techniques:

- Quality analysis, including the integrity and descriptive analysis of the data.

- Clarification of data-related queries.

- Initial data cleansing.

Phase 3: Preparing the data

Transformation of master data to build the final dataset that will be used in the development of the models:

- Construction of the dashboard, compiling all the information relevant to the modeling process.

- Multi-variant connection.

- Analysis of the relevance of the variables.

- Processing and transformation of the variables.

- Creation of synthetic variables.

Phase 4: Model and evaluation

Construction of the predictive model and evaluation of the quality of the model, ensuring that the defined requirements are met:

- Selection of the input variables for the model.

- Creation and selection of the forecast/default model considering aspects such as quality and understanding of the prediction process.

- Evaluation of the model through the appropriate methods.

Phase 5: Knowledge transfer

Transformation of the knowledge acquired within the business process in accordance with the requirements:

- Preparation of the functional document that facilitates knowledge transfer, with the aim of implementing the model in the systems.

- Creation of a scorecard to display the results.

Total implementation time: 3 months

everis Service Modality

Our services catalogue covers end-to-end advanced analytics models solutions: definition, design, deployment, maintenance and analysis of data. We offer our clients 2 options for the analysis and usage of data.

We offer our clients two data exploitation options:

1. Analytics As A Service:

The algorithms are in everis’s private environment. The client will receive / access the results in the agreed format.

- Update of forecasts upon receiving new data: A system of alerts is established to assess the quality of the forecasts:

- – If the quality is not adequate, the client can opt for occasional recalibrations.

- Recalibration of forecasts upon receiving new data: After the arrival of new data, everis will launch all the model recalibration processes (diagnosis, estimation and forecast) to maintain the predictive quality of the models.

2. Internally in the client’s systems:

The algorithms and the data servers & calculations are in the client’s private environment. Requires assessing hardware and software needs.

- Update of forecasts upon receiving new data: A system of alerts is established to assess the quality of the forecasts:

- – If the quality is not adequate, the client can opt for occasional recalibrations.

- Recalibration of forecasts upon receiving new data: Before the arrival of the new data, the client and everis needs to address how the everis team will access and launch the calculation algorithms and data servers.

Everis, your best technology partner

- Solutions. Comprehensive Analytics offering.

- Team. Analytics team of 150+ highly qualified and certified professionals, including financial experts, digital transformation controllers, scenario modelers and data specialists.

- Proven Results. Extensive experience in Cloud and onsite analysis solutions.

- Resources. Methodology, alliances, lab simulations, discovery sessions.

- Innovation Center. 16+ years of continuous growth in Business Analytics (eM, CDAC, eDIC, Co-Investment).

- Technology. Business Intelligence, Artificial Intelligence, Big Data, Advanced Cognitive Applications, RPA, Analytics programming languages (Phyton, R, etc.).

- Global. everis is a NTT Data Company, with 110,000+ professionals in 50+ countries and an annual revenue of US$ 16 billion.